Frequently Asked Questions

Get Started | Investing with OurCrowd | Investments & Due Diligence |

Founders Seeking Capital | Using the Website | OurCrowd's Foreign Currency Exchange Policy | About the Company |

Get Started

Why invest in startups?

Technology startups are changing nearly every aspect of life, creating explosive social and financial value. Most people have to wait for a company to go public before they can invest and be a part of a company's growth. By the time a startup goes public or gets acquired, much of the growth has been accrued by early private investors and investment banks. OurCrowd's global equity funding platform gives accredited investors exclusive access to participate in promising private startup funding rounds alongside top-tier VCs at the same terms, starting at $10,000.

How do I get started?

It is simple and free to sign up on the OurCrowd website and begin accessing our deal flow. Once your investment account is set up, you'll have full access to information about the startups and funds available to accredited investors.

Can I speak with someone from Investor Relations?

Yes, please contact us to schedule a call with an Investor Relations representative at a time convenient for you.

Investing with OurCrowd

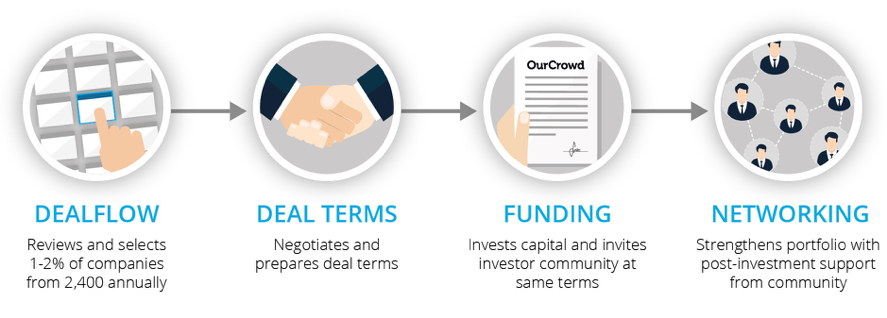

How does OurCrowd's investment process work?

Through our extensive and growing network, OurCrowd pursues promising startups to invest in selective, high-demand investment rounds, often along top tier VCs. OurCrowd's team of investment professionals reviews between 150-200 startup companies every month, typically meeting 20-30 management teams face-to-face. OurCrowd then conducts in-depth due diligence and negotiation in order to select, on average, 2-3 investment opportunities per month. OurCrowd invests its own capital in every portfolio company alongside its investor community and provides the same terms as institutional co-investors in the round.

What are the options for investing with OurCrowd?

OurCrowd investors access investment opportunities in three ways: by selecting startups individually for investment (Startup Select), investing in funds, or via a pre-funded investment account called a Portfolio Reserve. Learn more about how to invest.

What is OurCrowd's fee structure?

Details about management fees and carried interest can be found here.

Why is accreditation a requirement?

Early stage, privately-held companies are high-risk investments, and many countries require individuals to meet specific criteria before being allowed to participate in these investments. OurCrowd follows local regulations regarding accreditation, which vary country-by-country, but generally address the following two questions:

- What are the criteria for the minimum level of income and/or net worth of investors who are allowed to participate in these types of investments?

- What proof do investors have to provide in order to satisfy that they meet these criteria?

Learn more about accreditation.

Why am I required to provide KYC?

To ensure OurCrowd continues to operate in full compliance with the highly regulated environment in which we operate, OurCrowd constantly reviews it processes to ensure we have appropriate and robust procedures in place to meet these regulatory demands. While we won't comment on the appropriateness and completeness of other companies' KYC protocols, we hope investors understand that our protocols are meant to ensure that we meet regulatory standards, protecting both OurCrowd and its investors.

Can residents of any country invest with OurCrowd?

Residents of most countries can invest with OurCrowd; the following are excluded from the list: Cuba, Iran, Lebanon, North Korea, Syria and the Crimea Region of the Ukraine.

Do I need to be a Qualified Purchaser to invest with OurCrowd?

Certain opportunities are limited to investors who are Qualified Purchasers. You do not need to be a Qualified Purchaser in order to participate in most OurCrowd investment opportunities. OurCrowd collects this information for regulatory purposes. (see full definition here )

Which currencies do you accept?

All investments are made in US Dollars. OurCrowd is able to accept funds from other specific currencies. See the FAQ section below on our foreign currency exchange policy for more details.

Do you share portfolio company financials?

OurCrowd balances the requests investors have for sensitive and confidential information of portfolio companies which they have invested in or are considering investing in, with the confidentiality that portfolio companies and their Boards understandably demand.

What kind of documentation will I receive after I invest?

Once the investment round by OurCrowd has fully closed, you will receive the executed articles of partnership from our finance team. You can watch a video about how this process works the first time you make an investment on OurCrowd.

What kind of updates will I receive about my portfolio companies?

Investors receive quarterly reports containing updates on company progress and estimated metrics. When relevant, investors also receive a monthly digest of news featuring their portfolio companies, as well as other timely updates relating to investments.

How do I access quarterly updates and other documents?

When signed in, access the My Portfolio page in the top right to review quarterly updates and other documents.

Can I speak with someone from Investor Relations?

Yes, please contact us and we will schedule a call with you a member of Investor Relations at a time convenient for you.

Do all OurCrowd investors invest on the same terms?

All OurCrowd investors are bound by the terms of the particular limited partnership agreement (or other similar agreement) governing their various investment opportunities. OurCrowd may occasionally enter into agreements (Side Letters) with certain investors providing them with rights that are additional to and/or different from the rights provided to other investors, but do not negatively affect other investors. For example, OurCrowd may grant certain preferential terms (such as fee discounts or early access to deal flow) to investors with whom OurCrowd has a strategic relationship or for investment amounts of a certain scale. OurCrowd may also accommodate legal requirements of an investor’s particular jurisdiction through a Side Letter. In general, OurCrowd is not required to notify other investors when providing a Side Letter or to disclose or offer such additional and/or different rights or terms to other investors.

On rare occasions, investors may be admitted to an OurCrowd investment vehicle at a late stage, without the requirement to pay the usual late admittance fees. This may occur where OurCrowd itself funds an investment commitment, either fully or partially, not previously taken up by OurCrowd’s investor base (in addition to OurCrowd’s own investment amount), and subsequently transfers such interest directly to a new OurCrowd investor at a later stage.

Investments & Due Diligence

What sectors does OurCrowd invest in?

OurCrowd is sector, stage, and geography agnostic. We invest in a range of sectors ranging from Agriculture, Consumer, Cybersecurity, Energy, Enterprise, FinTech, Healthcare, Mobility, and more. View the Portfolio page for an idea of the range of our portfolio.

What is OurCrowd's due diligence process?

OurCrowd's vetting process is comprised of five phases:

- Initial contact: 150-200 companies/month have initial contact with OurCrowd's investment team and are vetted accordingly.

- Scheduled meetings: OurCrowd schedules initial pitch meetings with potential startups.

- Due diligence: Various diligence meetings take place to dive further into analysis.

- Investment committee: The startup is presented to OurCrowd's senior investment committee for a final decision.

- Fundraising: Once the term sheet is signed, the startup is added as an investment opportunity on OurCrowd’s website platform. Expect closing to occur anywhere between 45-60 days from launch.

Should I do my own due diligence on companies?

OurCrowd provides extensive materials to help investors make their own investment decisions. This includes webinars with a company's founder/CEO, in-depth analysis by our investment team, company pitch deck, global events, and more. OurCrowd's due diligence materials are available on the currently funding startup's page, accessible when signed in, from Browse Portfolio.

Founders Seeking Capital

I am an entrepreneur looking for investment, what are the next steps?

Our deal flow team sees around 150 new startups on average per month. To submit your company’s information for review, click here.

How much money can a company raise through OurCrowd?

A typical round of investment through OurCrowd’s platform is anywhere between $2M to $20M. We often participate in larger rounds of investment alongside top tier venture capital funds and other large institutional investors.

Using the Website

How do I reset my password?

Click Sign In at the top right and click Reset my password.

Where can I see my investment documents?

When logged in, in the top right, click My Portfolio. You will see a tab called My Holdings with a list of your investments, the investment amounts, fair value, reports, and more. Watch a short video on how to navigate this section .

How do I change the email address associated with my log in?

If you’d like to change the email address with which you log in to OurCrowd, please contact Investor Services at investor.services@ourcrowd.com .

OurCrowd's Foreign Currency Exchange Policy

How does it work?

OurCrowd wants to make it easier to fund investments and has engaged Airwallex Group to offer a foreign currency exchange service which is available in many countries. The service is provided under the Legal Terms set forth below.

Since OurCrowd works in USD, investors will continue to have the option of wiring in USD. However, OurCrowd is also providing the option to convert from many local currencies (listed below) to USD. Investors residing in any of the relevant countries, will have the option to transfer funds in a local currency and Airwallex Group will handle the foreign currency exchange service.

How can OurCrowd offer a guaranteed rate?

OurCrowd is partnering with Airwallex Group, a licensed payment and financial services provider offering financial services and software as a service (SaaS), made up of entities licensed in various jurisdictions. Founded in Melbourne, Australia in 2015, (currently headquartered in Hong Kong) the company is a financial services platform providing foreign exchange transactions to principally small and medium-sized businesses through a proprietary banking network and its API. OurCrowd invested significant time doing its due diligence with Airwallex Group, one of the most established companies in the FinTech ecosystem, as part of this partnership which is designed to benefit OurCrowd investors.

What is a guaranteed rate?

A guaranteed rate is precisely as one would expect – a foreign currency exchange rate that is guaranteed for a specific period of time, with the few exceptions which are outlined below.

We will guarantee the rate for a 24-hour period once an investor completes setting up a transfer. It is important to send funds as soon as possible after completing the flow, so that we receive them within the guaranteed time period.

Why should I use a guaranteed rate?

Choosing this option will likely be less costly than converting the funds with a local bank, due to the attractive rates that OurCrowd offers. However, investors should be aware that similarly to a bank, OurCrowd will charge an additional 0.6% fee of the commitment amount.

Which foreign currencies does OurCrowd offer exchange rate services for?

We offer foreign currency exchange services for funds from the following countries and currencies:

- Australia when funding in Australian Dollar (AUD)

- United Kingdom when funding in British Pound Sterling (GBP)

- Singapore when funding in Singapore Dollar (SGD)

- New Zealand when funding in New Zealand Dollar (NZD)

- All European countries who have the EURO (EUR) as currency (20 countries) Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain

We can only accept payment in Euros from the countries where it is used as the principal currency.

Supported Currencies are subject to changes from time to time at our sole discretion.

Where can I find the foreign currency exchange details for my investment?

Investors can always log-in to My Portfolio page and view the status of each investment under the “Pending” section.

On that page, investors can see the investment’s status, the actual rate used and how much OurCrowd received; this information will include either the guaranteed or market rate.

If I change my mind, can I receive a new rate?

Yes. Investors who received a rate that is about to expire or want to change the currency, can get a new rate by selecting “Update Payment Options” on the wiring instructions page. On the My Portfolio page, go to the “Pending” section and click on “Fund Your Investment”.

Investors who haven’t yet transferred funds, will see the wiring instructions again and a button to receive a new rate for the same investment in the bottom left corner. Those who already wired funds, and clicked on “I made the transfer”, will not be able to receive a new rate.

What happens if I miss the 24-hour time window?

Following the 24-hour period, the guaranteed rate will expire. As a result, OurCrowd will use the market rate at the time funds are received. This rate could either be lower or higher than the guaranteed rate previously locked in. It is important, therefore, to send funds as soon as possible.

For investors who haven’t wired within the first 10 hours of the 24-hour lock period, we highly recommend they select "Update Payment Options" via the wiring instructions page. Otherwise, funds will likely not arrive within the 24-hour time window.

What if the market rate significantly differs from the guaranteed rate?

Missing the 24-hour time window, could lead to a difference between the amount received by OurCrowd and the investor’s commitment amount. As a result, investors might be required to take additional actions. For example:

If the funds in USD are less than the amount committed, we will ask to wire the outstanding funds according to the updated rate or decrease the commitment.

Or there are three potential options if the funds in USD are more than the amount committed;

- The investor will be able to distribute the excess funds, and either reinvest or transfer to another deal;

- The investor can request a refund;

An account manager will contact the investor to handle these situations.

- The investor can choose to increase the commitment.*

*This is only an option if the deal has not exceeded its funding target. Decreasing or increasing the commitment amount will require the investor to re-sign the LP agreement.

What happens if there is a market disruption, an error, or a force majeure event?

If a market disruption occurs after the exchange rate has been provided, the rate may be revised with immediate effect and the guaranteed rate will not apply (even within the 24-hour time window). A market disruption means any event which, in OurCrowd’s sole discretion: (i) has the effect of hindering, limiting or restricting the ability to obtain a firm quote of an offer price, convert any currency into any other currency, or to transfer any sum to any other country or within the same country; (ii) results in any purchase currency not being available in the interbank foreign exchange market in accordance with normal commercial practice; or (iii) constitutes unusual price volatility in the foreign exchange markets.

In addition, if a conversion is executed at a rate that clearly and materially deviates from the market price, the investor must not rely on such obvious error. In such cases, OurCrowd may cancel the conversion and it will need to be reprocessed at the correct rate.

The rate may also be revised due to force majeure events beyond OurCrowd’s reasonable control such as Black Swan events; strikes, lock-outs, labor troubles; interruption or failure of a utility service including the internet, electric power, gas or water; riots, war, pandemic, or terrorist attack; nuclear, chemical or biological contamination; extreme abnormal weather conditions; the imposition of a sanction, embargo or breaking off of diplomatic relations; or any change in applicable law.

Can I send my transfer during the weekend? If so, will I still be able to use the original rate?

Investors may send transfers over the weekend, but we highly recommend transferring funds during global business hours to receive the guaranteed FX rate. If a transfer is processed during non-banking hours, it is likely the original rate will not be in effect. We strongly recommend initiating transfers only on business days as on weekends there is no FX trading and therefore no FX conversions.

Investors sending transfers without FX conversions may send transfers over the weekend with no issues besides a slight delay in confirmation time.

How will I know OurCrowd received my funds?

Once OurCrowd receives funds, a confirmation email will be sent, notifying the funds have been received and are being processed.

In addition, investors can always log-in to their My Portfolio page and view the status of the investment under the “Pending” section.

Investors can log-in and see the investment status, the actual rate used and how much OurCrowd received; this information will include either the guaranteed or market rate.

What are the legal terms?

Since OurCrowd doesn't provide payment services and without derogating from any other agreement the investor has entered into with OurCrowd, by using the foreign currency exchange services or wiring funds through Airwallex Group (together, the “Services”), the investor accepts the following terms and conditions:

OurCrowd does not make any commitments about the content or data provided in connection with these services, the specific functions of the services or their accuracy, reliability, availability or ability to meet the investor’s needs. OurCrowd cannot guarantee that the services will operate uninterrupted or error-free, that they will always be available, that the information they contain is current or up-to-date, that they will be free from bugs or viruses, or never be faulty. OurCrowd may suspend or terminate the services at any time, without notice, in its sole and complete discretion.

THE SERVICES ARE OFFERED ON AN “AS-IS” BASIS. TO THE FULLEST EXTENT ALLOWED UNDER APPLICABLE LAW, OURCROWD MAKES NO REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED, INCLUDING WITHOUT LIMITATION ANY WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE OR NON-INFRINGEMENT, WITH RESPECT TO THESE SERVICES AND USE THEREOF.

IN NO EVENT WILL OURCROWD, ITS AFFILIATES, EMPLOYEES OR OFFICERS BE LIABLE FOR ANY DAMAGES OR LOSSES OF ANY KIND WHATSOEVER RESULTING TO THE INVESTOR OR TO ANY THIRD PARTY DIRECTLY OR INDIRECTLY FROM ANY USE OF THESE SERVICES OR DEFECT IN THESE SERVICES OR ANY INFORMATION CONTAINED HEREIN OR UNAVAILABILITY OR MALFUNCTION OF THESE SERVICES, OR UNAVAILABILITY OF THE GUARANTEED RATE (INCLUDING DURING ANY GUARANTEED TIME WINDOWS), OR THE INVESTOR’S INABILITY TO COMPLETE AN INVESTMENT DUE TO ANY OF THE FOREGOING, INCLUDING BUT NOT LIMITED TO CONSEQUENTIAL, PUNITIVE, INCIDENTAL OR OTHER INDIRECT DAMAGES, OR LOSS OF INCOME, REVENUE, BUSINESS OR PROFITS, EVEN IF OURCROWD HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGE OR LOSS AND EVEN IF SUCH DAMAGE OR LOSS WERE REASONABLY FORESEEABLE. IF THE FOREGOING LIMITATION OF LIABILITY IS NOT ENFORCEABLE, LIABILITY OF OURCROWD IN CONNECTION WITH THESE SERVICES, USE THEREOF OR INFORMATION APPEARING THEREIN OR ANY OTHER MATTER IS LIMITED TO US $500 DOLLARS. BY USING THESE SERVICES, THE INVESTOR EXPRESSLY ASSUMES ALL RISK RELATING TO THESE SERVICES AND USE THEREOF.

About the Company

What is OurCrowd?

OurCrowd is a global equity investment platform, bringing venture capital opportunities to accredited investors worldwide. In 10 years, OurCrowd has built a global community of more than 225,000 investors, entrepreneurs, mentors and partners, funded more than 400 startups and received investment commitments totalling more than $2.2 billion. OurCrowd is managed by a team of seasoned investment professionals led by serial entrepreneur Jon Medved. OurCrowd vets and selects companies, invests its own capital, and invites its accredited membership of investors and institutional partners to invest alongside OurCrowd in these opportunities. OurCrowd provides ongoing support to its portfolio companies, assigns industry experts as mentors, and creates growth opportunities through its network of strategic multinational partnerships.

Who is behind OurCrowd?

Jonathan Medved is the Founder and CEO of OurCrowd. Named by the Washington Post as “one of Israel’s leading high tech venture capitalists” and by the New York Times among the “top 10 most influential Americans who have impacted Israel,” Jon is a serial entrepreneur and investor, and one of the pioneers of Israel’s venture capital industry. Jon is a regular television guest on CNN, BBC, CNBC, Bloomberg TV and SkyNews, and is frequently quoted in major business publications. Start-up Nation, the best-selling book on Israel’s high-tech economy, describes him as “one of Israel’s legendary business ambassadors.” A California native, Jon moved to Israel in his 20s where he successfully built and exited several startups. These include MERET Optical Communications, a fiber optics pioneer sold to Amoco; multilingual leader Accent Software (Nasdaq: ACNTF); and mobile video platform Vringo (NYSE:VRNG). In 1994, Jon was a co-founder of Israel Seed Partners, one of Israel’s first venture capital funds. Including the OurCrowd portfolio, Jon has backed over 400 tech startups as a venture capitalist and angel investor.

Steven Blumgart, co-founder and Chairman of OurCrowd, is a leading investor and philanthropist. Steven was part of the senior management team at Glencore International (GLEN.LE) where he headed its aluminum business.

Is OurCrowd GDPR compliant?

Yes. OurCrowd meets the regulations in accordance with the European Data Protection Law. View complete details in our privacy policy available here.

What is OurCrowd’s position on social responsibility?

In 2013, OurCrowd became the first fund to require its Israeli companies to commit equity to a charitable cause, demonstrating its commitment to the nonprofit world in a notable way. Additionally, OurCrowd is heavily involved in the Israeli public service venture fund, Tmura. These requirements are integrated into the term sheets and investment contracts with portfolio companies.

How can I arrange an event or speaking engagement with OurCrowd?

For speaking opportunities, sponsorship inquiries, events, or to be a host, please contact OurCrowd's Global Events Project Manager, Alice Ben David at alice.bd@ourcrowd.com.

Can I speak with someone from Investor Relations?

Yes, please contact us to schedule a call with an Investor Relations representative at a time convenient for you.

Didn't find what you were looking for? Ask us here